Warning: This article may be triggering. If you reside in Nigeria and are affluent enough to take your mental health seriously, please read on. If you are not, please leave now. You’ve been warned.

June has been an interesting month; I just returned from the BLOOMBERG Africa Business Media Innovators 2025 conference. This was my third outing (previously, I was in Dakar, Senegal, and Cape Town, South Africa). As always, it’s inspiring to meet with some of the leaders pioneering this challenging landscape across the continent. The backdrop of the conference and that week was the flood of articles regarding the death of iROKOtv. At first, like with any social media firestorm, I simply ignored it. Then, when pushed for clarification, I updated the current reality of iROKOtv. That didn’t seem to work, as I was inundated with posts, vlogs, and discussions about what went wrong and what happened to the $100 million or so (aside from creating one of the largest Nigerian movie libraries, the channels, and the significant documented losses in trying to ignite streaming in Africa). If there is anyone who has shared the struggles and built somewhat publicly in Nigeria over the last 10+ years as I have, I would love to meet that person and treat them to a nice hot meal.

iROKOtv isn’t dead. At least to my direct knowledge, none of my personal bank accounts have ever been frozen; at least my monthly trips to Lagos would have noticed that. Perhaps if you think in venture-backed, change-the-world-to-the-moon-or-death style, sure. That step change happened when I acquired majority control back in 2023 and exited the previous venture investors. But in the normal commercial world, it’s a family-owned, micro-profitable scale-up. It’s given me 15 years of headaches that I believe I have been open about for years. What surprised me was the article I wrote being mutated into a headline that I invested $100 million (raised capital, retained revenues, and content deals) into trying to build a Nigerian first national champion and failed. All of this is true. That it was shuttered and exited Nigeria was less so. If anyone had bothered to go to the iROKOtv site/app stores etc., download, and attempt to pay, they would have seen that it was very much available for users globally. I just stopped accepting Naira almost two years ago. The good thing now is that after two years, Naira cards can now make $ withdrawals and payments (limited to $1,000 per quarter). In that same two years, the turbulence in the FX markets was just too much of a headache to deal with. Sure, iROKOtv Nigeria bank accounts were frozen as part of a debt restructure negotiation taken to extremes (if you go nuclear, is there a plan B?). Again, this is something I have mentioned before. When I acquired back iROKO from prior shareholders, the company took on ALL previous liabilities, which included $3 million+ in debts (which a significant amount has been paid down or restructured). Anyway, that is the cost of ambition, and folks, vs the option of simply selling ROK and cashing out, walking away with retirement money, I bet all on black on myself, and let’s just say it’s still very much a work in progress. iROKOtv still has a small remote team in Nigeria, and we keep on plugging away. So thanks to all those who reached out with words of concern. I’m disappointed only one organization reached out to ask whether it was true or not, with the other 50+ just posting largely clickbait articles and think pieces. I guess this is why I took my narrative-making into my own hands all those years ago. But negative news moves, and I find it best to just let the news cycle play out vs trying to navigate it in real-time. Anyway, the actual article that led to the fake storm is linked below.

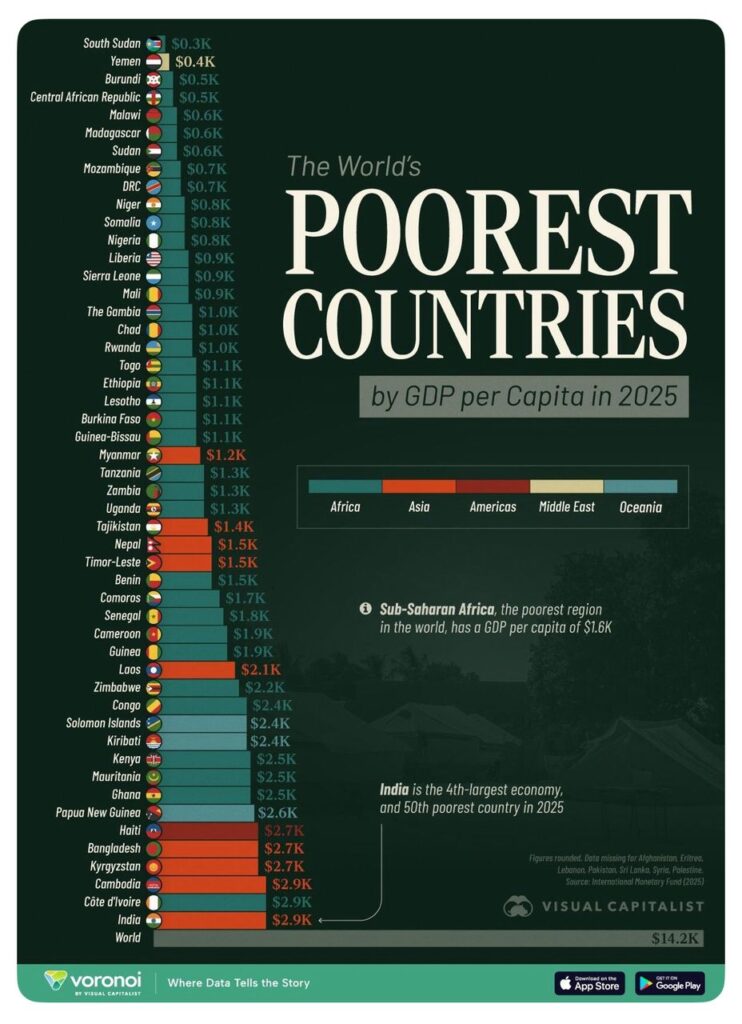

I just returned a few weeks back from attending the Salon International du Contenu Audiovisuel d’Abidjan. Organised by the Ivorian Ministries of Communication, Culture and Tourism, the SICA aimed to showcase content and talent from across Africa. It is essentially a platform that brings together creators, producers, broadcasters, platforms, distributors, and financiers from Africa and beyond to foster collaboration on future projects and explore the diverse opportunities offered by the African audiovisual and film markets. Below is the picture of myself and the Ivorian Minister of Communication and Digital Economy, Amadou Coulibaly. June was an interesting time meeting folks from across the entertainment landscape. Monetization, or the lack of it, is going to be the dominant conversation over the next 5 years. I struggle to see how you can disconnect the startups’ successes from the economies in which they are.

Operating on the sub-Saharan continent of Africa is operating in hard mode. Collectively, we represent 13% of the world’s population but only <2.5% of the global GDP or trade output. That population versus trade gap explains why we are generationally poor. Entertainment is one of those things that laypeople always express strong yet usually entirely wrong opinions about. The Nigerian generational poverty limits the scale and ambition of entertainment startups and companies across the country. It’s as simple as that. So no matter how hard you try, there is an upside limit to what you can realistically generate from the masses of functionally illiterate and largely unproductive 100 million or so Nigerian population (that 200 million+ is fantasy as we have NEVER had an agreed-upon census and the weak data available never really connects). These words may sound harsh, but they are unfortunately what they are. I now solidly believe in community wealth versus individual wealth. Call me a champagne socialist if you will. No matter how individually wealthy we may become, if our communities are poor, we are a reflection of that poverty. There will be a limit to how you are regarded, treated, and interacted with, and that is ultimately how they perceive your wider community. Want to understand this? Look at how Americans’ H1B visa conversations turned out. The European-centric white US establishment turned on the Indians in America and then ridiculed the home countries as slums. It was brutal for a community that has succeeded beyond most immigrant groups to be pilloried in this way. Yet look at how the political, military, business, and technological elite view China. As peers, as the greatest threat to their hegemony, with the utmost respect. As a competitor. That respect has more to do with intellectual prowess and community-level GDP growth than it has to do with raw capital. If you want to understand simple raw cash capital respect, just look at how Trump forces all global leaders to come and kowtow in the Oval Office. But when it’s time for his very limited foreign trips, he can jump on a plane and tour across the GCC (Kingdom of Saudi Arabia, United Arab Emirates, or Qatar). They have marginal populations but arguably the most deployable capital on planet Earth right now. When I form opinions, I usually cast the net wide and speak to as many focused players as I can. So the leaders of streaming for Netflix and Amazon were people I knew personally, and I solicited their opinions. Even in entertainment markets where it appears things are going much, much better (music is driven by global diaspora revenues), the continental situation is still tough. Last month, I was fortunate enough to sit down for a many-hours dinner with my longtime friend Jocelyne (MD of Spotify Africa). Aside from YouTube, they have been doing incredibly well over the last few years and are still very much focused on long-term continent-wide domination. From what I have seen, and as a long-term paying member, I don’t see who stops them. Recorded music revenues in sub-Saharan Africa grew by 22.6% in 2024 to $110 million, according to the IFPI’s report. Before we run away from ourselves, in 2024, Spotify disbursed a total of $10 billion in royalties worldwide. Nigeria and South Africa, the two biggest markets for Spotify in Africa, have particularly benefited from this growth. In 2024, Spotify paid approximately $59 million in royalties to artists from these two nations. Just to be clear, Nigeria and South Africa represented 0.59% of their global royalties dispersed. That’s equivalent to say, what Bad Bunny, with his 12B streams in 2024 alone earns from the platform. So, for now, Afrobeats taking over the world hyperbole is still slowly being cooked.

I actually believe that even with harder mode turned on, the easiest place for Africans in the world to make $1-5 million in wealth remains on the continent of Africa. The competition is largely with other Africans, and the nuances of building in these environments make the process very local-centric. No matter how small the economy, the core activities will be able to generate this. With that said, if you genuinely wanted to drive into the $10-50 million range in a compressed period of time (this requires long-term planning, a favorable macro environment, and policy stability—things you don’t really get in these parts). That’s why there are so few actual legit billionaires; other than the top 5 countries, few have economies that can actually support that scale. Think colossal Nigerian banking GTCO, which is valued at $1.775 billion. So, godspeed to founders in Ghana, Zambia, or Mozambique creating that scale of wealth from their local economies.

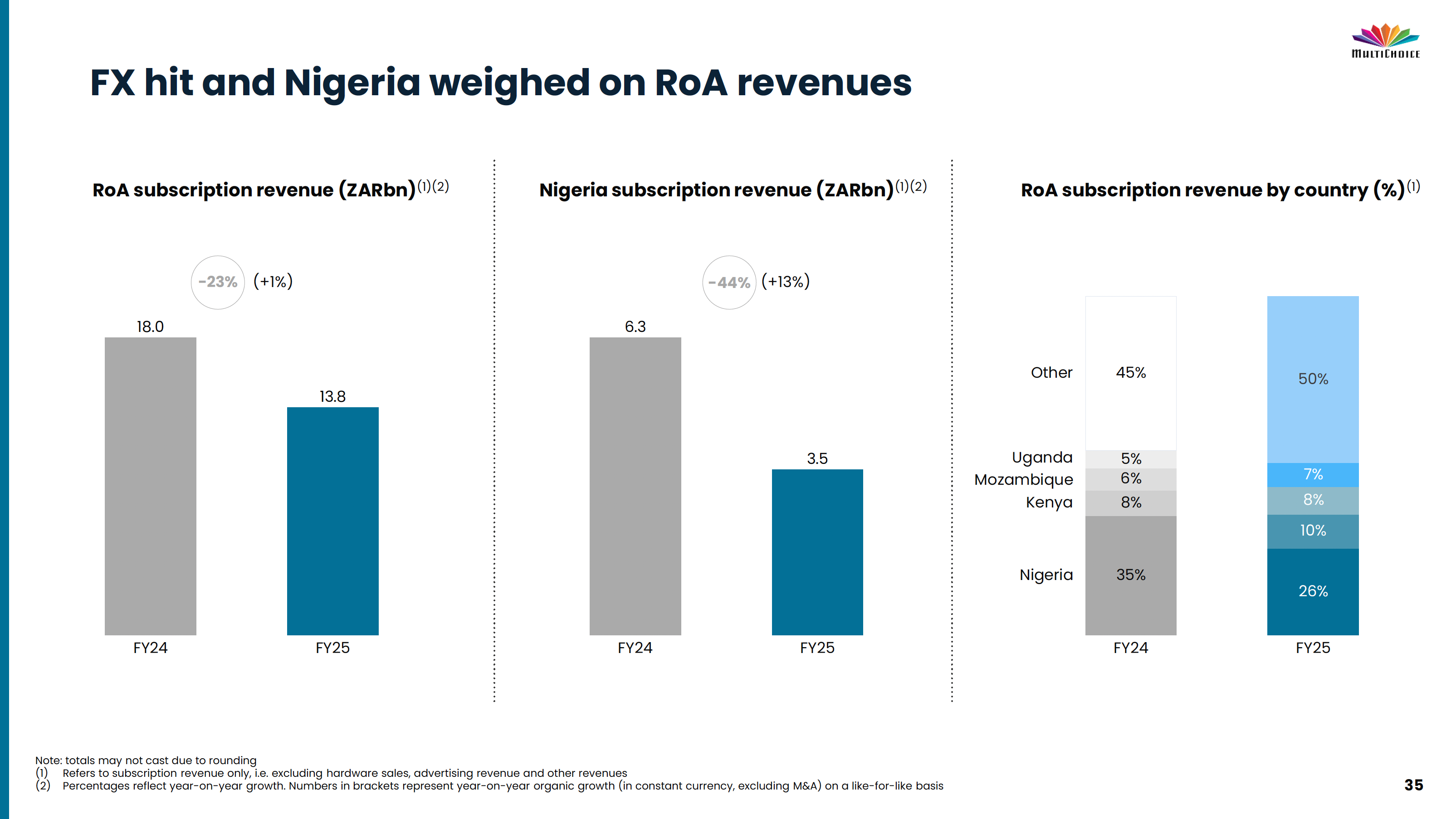

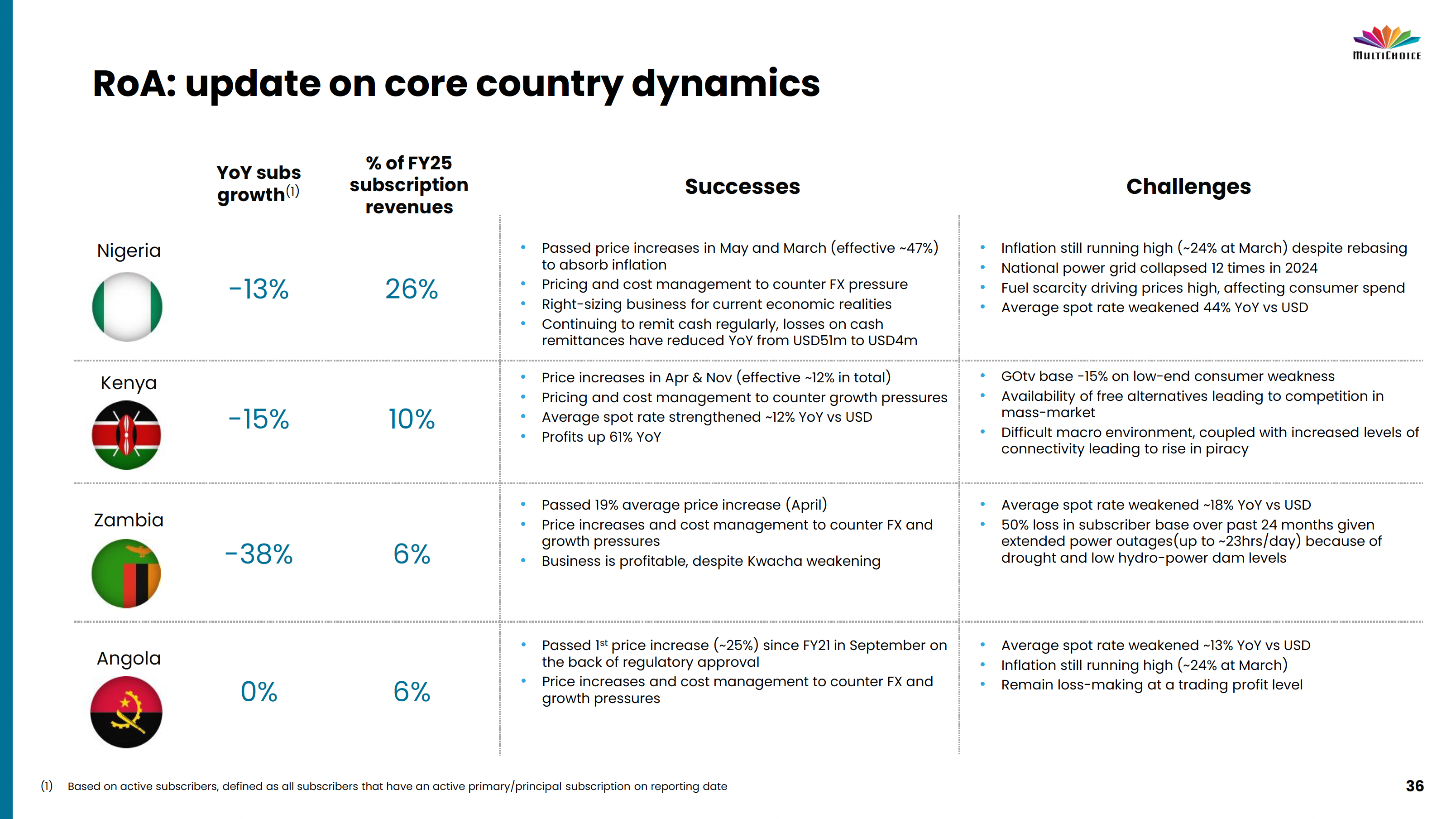

Anyways, Multichoice’s recent data is illustrative of what that Nigerian reality really means in the coldest sense. So, the summary first.

- The Showmax streaming bet is a gargantuan hail Mary one that wipes out almost all of their operating profits. The FYI 2024-25 combined losses were $422 million on $90 million in revenues. That’s in 2 years. So, the context behind my $100 million over 15 years is clear. We were never really in the game.

- To throw into context, the content budget for Netflix over 5 years just in Africa was close to $160 million, moving aside the massive cost advantage of decades of tens of billions in content, marketing, and

- The macro turbulence of Nigeria lays at the center of almost all Multichoice’s economic woes (-44% revenues) to $194 million for the most recent financial year. They made more in dollar terms several years ago. In Naira terms, they are driving real value. But you can’t outrun a devaluation. You can only try.

- You can’t outrun the massive devaluations and destruction of consumer spending witnessed in the last 2 years. We are somehow deluded that GDP can drop 50% and everything can somehow be normal in the entertainment industry. Netflix and Amazon simply dialed back and focused their executive efforts elsewhere. Mind you, to my knowledge, Netflix never had employees on the continent.

So, hats off and much respect for those on the continent toiling away building and creating wealth in the harder climes known on planet Earth. We salute you.